do you pay taxes on inheritance in north carolina

Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. These include capital gains retirement account income tax and other similar taxes.

State Taxes For Retirees Social Security Pensions Military

Inheritances are not considered income for federal tax purposes whether you inherit cash investments or.

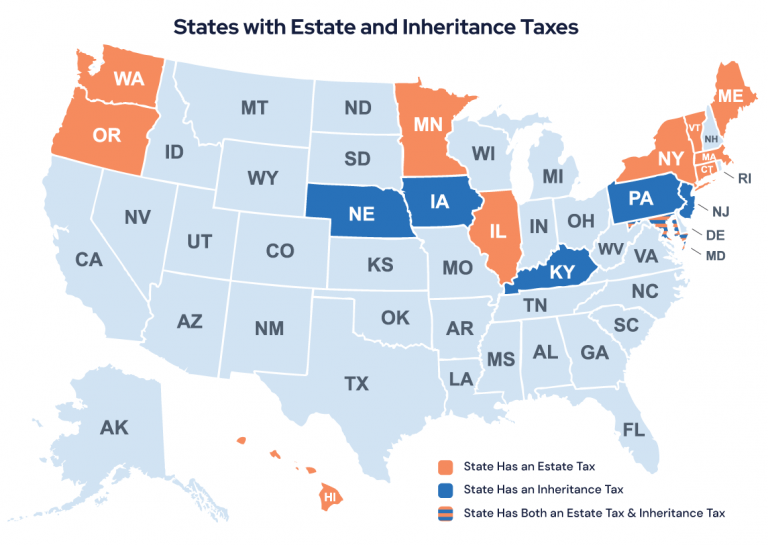

. What taxes do you pay when you inherit. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits.

That is 152 million. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. With the property tax your federal tax would be 187 million.

There is no inheritance tax in NC. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

Advertisement - Article continues below. IRAs that distribute large amounts of income each year according to the new 10-year payout rule may cause heirs to pay taxes on the distributions. Estate tax or inheritance tax.

Estate taxes are imposed on the total value of the estate - if the total estate value is large enough - the executor executor of the estate must file federal and a North Carolina estate tax returns and pay any tax due within 9 months after the death. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. While you probably dont have to pay inheritance or estate tax other taxes may apply.

However the federal government still collects these taxes and you must pay them if you are liable. North Carolina residents do not need to worry about a state estate or inheritance tax. There is no inheritance tax in North Carolina.

North Carolina residents do not need to worry about a state estate or inheritance tax. Federal estate tax could apply as well. Residents of 13 states who receive debt forgiveness from the federal government for their student loans may need to pay some state taxes on their forgiven amount according to an analysis by the.

However residents of the state should keep in mind that they are subject to the federal estate tax if the value of either their estate or the estate they are. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate jurisdiction might apply. Will I have to pay a North Carolina inheritance tax.

It has a progressive scale of up to 40. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state.

However - there is no inheritance taxes on neither federal nor state level in North Carolina. There is no inheritance tax in North Carolina. Does NC have an estate or inheritance tax.

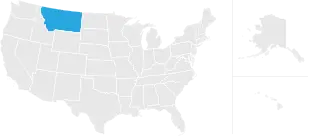

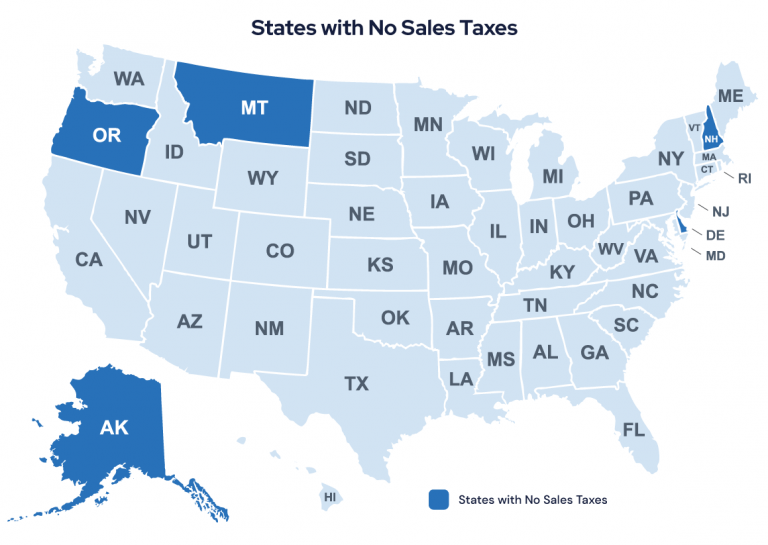

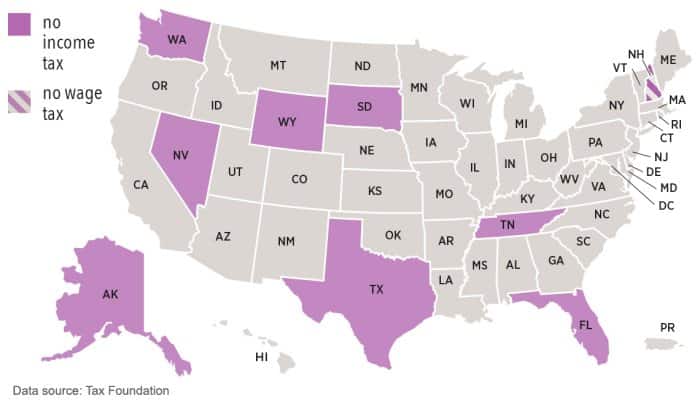

You pay inheritance tax as part of your. However according to some inheritance laws of South Carolina not all the deceased persons property may be considered as a. North Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

No Inheritance Tax in NC. However there are sometimes taxes for other reasons. There is no gift tax in North Carolina.

That way a joint bank account will automatically pass. Overall Rating for Taxes on RetireesMixed tax picture. Inheritance Tax in North Carolina.

Do you have to pay taxes on inherited property that was sold. In North Carolina you are not required to pay state estate tax or inheritance tax. These are some of the taxes you may need to consider for your heirs.

North Carolina Inheritance Tax and Gift Tax. However there are 2 important exceptions to this rule. North Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

North Carolina does not collect an inheritance tax or an estate tax. North Carolina does not collect an inheritance tax or an estate tax. North Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

For more information on these and other North Carolinastate taxes see the North CarolinaState Tax Guide for Retirees. This gift-tax limit does not refer to the total amount you can give within a year. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

In North Carolina the median property tax rate is 773per 100000 of assessed home value. An inheritance of 382 million falls into the highest tax rate so youll have to pay 40. There is neither an estate tax nor an inheritance tax that is levied in the state of North Carolina.

According to the new 10-year payout rule inherited IRAs that distribute large amounts of income each year may require heirs to pay taxes. However state residents should remember to take into account the federal estate tax if. However there are sometimes taxes for other reasons.

The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40.

Montana Income Tax Calculator Smartasset

These Are The 10 Best Neighborhoods In Chicago To Live In Chicago Neighborhoods Best Places To Retire Chicago

State Taxes For Retirees Social Security Pensions Military

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

-jpg.jpeg)

Tax Account Tips What Is Step Up In Basis

Lower Taxes Please Escape High Taxation In These 7 Tax Friendly States

Fast Guide To Dual State Residency High Net Worth Investors

What To Do If You Miss Your Rmd Deadline Smartasset

State Taxes For Retirees Social Security Pensions Military

.png)

Taxes On Lawsuit Settlements Everything You Need To Know Ageras

Taxes On Lawsuit Settlements Everything You Need To Know Ageras

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits